19

Automatic VAT 1 and automatic tax 2-4 system

This system enables the calculation in the combination with automatic VAT 1 and automatic tax 2 through 4. The

combination can be any of VAT1 corresponding to taxable 1 and any of tax 2 through 4 corresponding to taxable

2 through taxable 4 for each item. The tax amount is calculated automatically with the percentages previously

programmed for these taxes.

• The tax status of PLU/subdepartment depends on the tax status of the department which the

PLU/subdepartment belongs to.

• VAT/tax assignment symbol can be printed at the fixed right position near the amount on the

receipt as follows:

VAT1/tax1 A

VAT2/tax2 B

VAT3/tax3 C

VAT4/tax4 D

When the multiple VAT/tax is assigned to a department or a PLU, a symbol of the lowest number

assigned to VAT/tax rate will be printed. For programming, please refer to “Various Function

Selection Programming 1” (Job code 66) on page 47.

OPTIONAL FEATURES

Percent calculations (premium or discount)

Your register provides the percent calculation for the subtotal and/or each item entry depending on the

programming.

• Percentage: 0.01 to 100.00% (Depending on the programming) (Application of preset rate (if programmed)

and manual rate entry are available.)

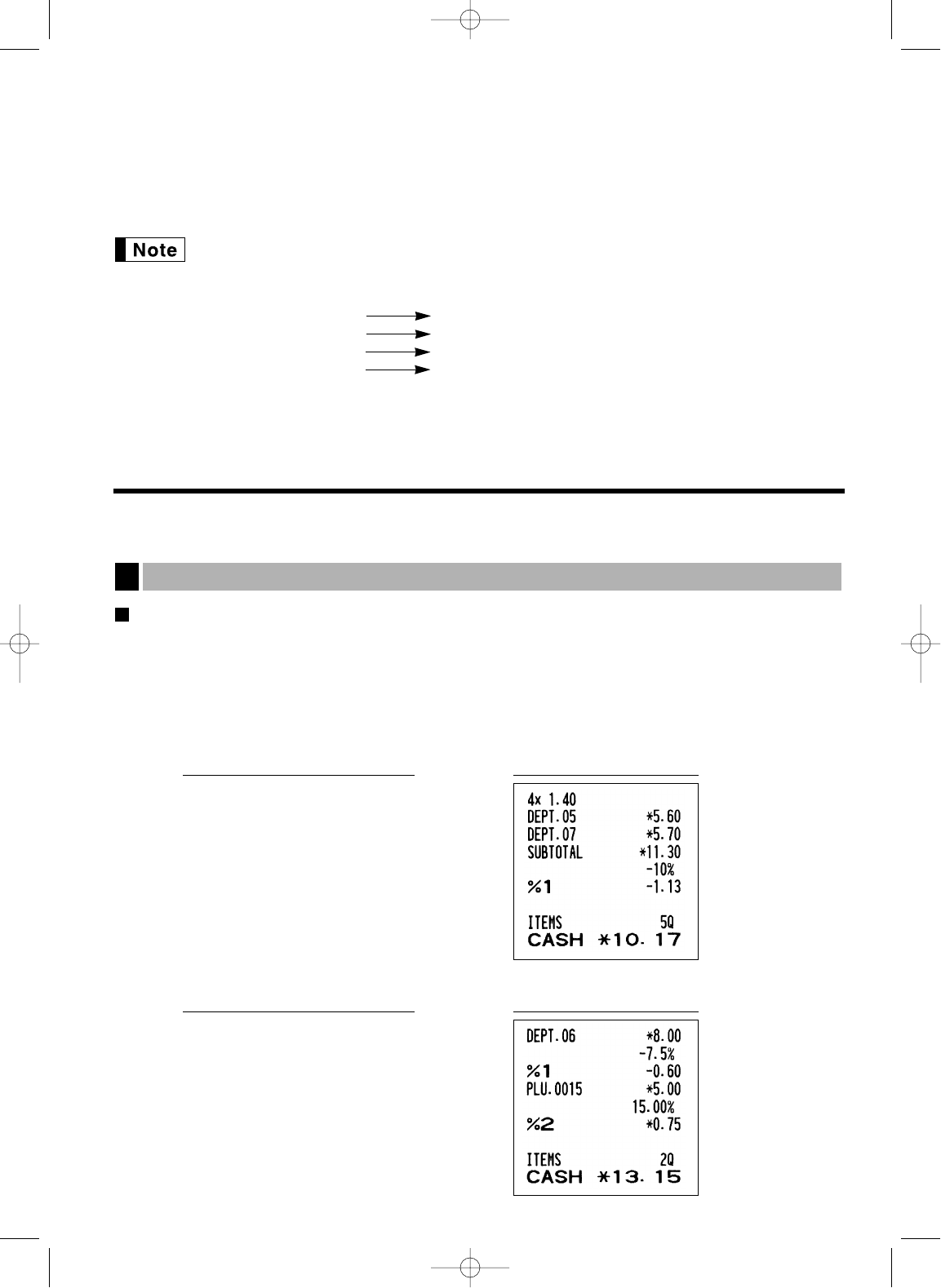

Percent calculation for subtotal

Percent calculation for item entries

800

§

7

P

5

%

15

p

&

A

(When premium and 15% are

programmed for the

&

key)

Receipt printKey operation example

4

@

140

∞

570

¶

m

s

10

%

A

Receipt printKey operation example

Auxiliary Entries

1

A301_2(En) 03.4.24 7:37 PM Page 19